Home / Guide to IRS Demand Letters /

Receiving a CP14 notice from the IRS can be an alarming experience. This notice informs you that there’s a balance due on your tax account, which is usually a result of unpaid taxes for a particular year. In this blog post, we’ll explore the significance of a CP14 notice, the importance of timely response, and how a tax professional can be instrumental in resolving this issue.

What is an IRS CP14 Notice?

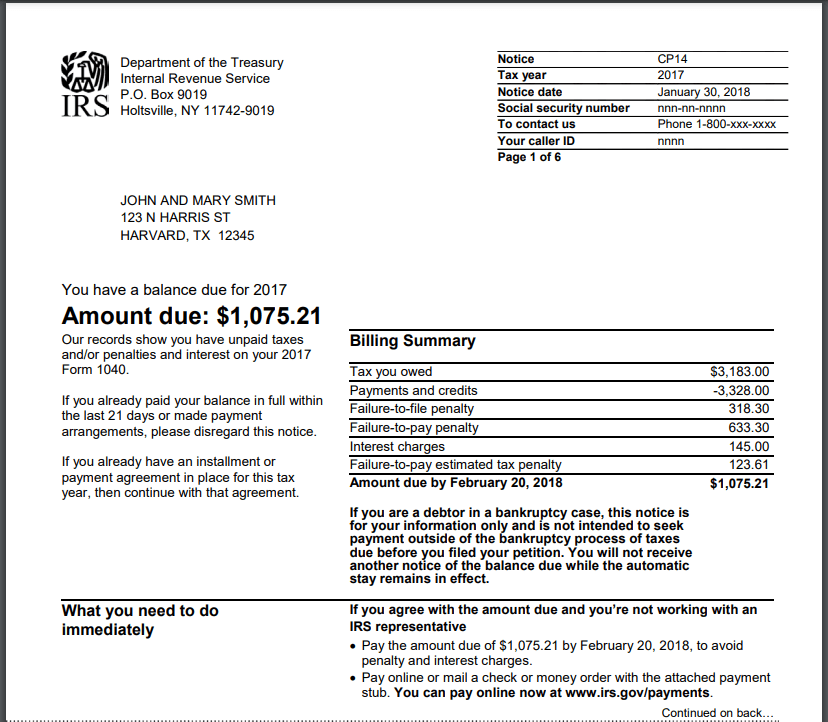

The CP14 notice is one of the most common notices sent by the IRS. It’s an alert that you owe money on unpaid taxes. This notice includes details such as the amount owed, the tax year in question, and instructions on how to make the payment. It’s crucial to address this notice promptly to avoid additional penalties and interest.

The Dangers of Waiting Too Long to Respond

Ignoring or delaying your response to a CP14 notice can have severe consequences:

- Accruing Interest and Penalties: The amount you owe can quickly increase due to penalties and interest.

- Liens and Levies: The IRS may issue a tax lien against your property or levy your bank accounts and wages.

- Impact on Credit Score: Tax liens can significantly damage your credit score, affecting your ability to get loans or credit in the future.

- Legal Consequences: In extreme cases, particularly if fraud is suspected, you could face legal repercussions.

Taking Prompt Action

Responding to a CP14 notice should be a priority. Here are the steps you should take:

Review the Notice Carefully: Ensure that the details, especially regarding your tax filings and the amount owed, are correct.

Consult a Tax Professional: Before making any payments, it’s advisable to consult a tax professional to explore all available options.

Communicate with the IRS: If there are discrepancies or if you need more time to pay, communicate this to the IRS. Do not ignore the notice.

The Role of a Tax Professional

A tax professional can play a pivotal role in resolving issues related to a CP14 notice. Here’s how:

- Clarifying the Situation: Tax professionals can help decipher the complexities of the notice, ensuring you understand why you owe the amount stated.

- Verifying Accuracy: They can assist in verifying the accuracy of the notice. Sometimes, errors occur, and you might not owe as much as the IRS claims.

- Navigating IRS Procedures: Tax professionals are well-versed in IRS procedures and can guide you through the necessary steps to resolve your tax issue.

- Setting Up Payment Plans: If you’re unable to pay the full amount, a tax professional can help negotiate a payment plan with the IRS that’s feasible for your financial situation.

- Representing You: In cases where the notice leads to more significant tax issues, having a professional represent you in communications with the IRS can be invaluable.

- Make Payment Arrangements: If the amount is accurate and you owe taxes, make arrangements to pay the debt. This could be a lump sum payment or a payment plan.

Receiving an IRS CP14 notice can be a stressful experience, but it’s not the end of the world. With the assistance of a tax professional, you can navigate this situation effectively. Remember, the key is to act promptly and not let the problem escalate. By tackling the issue head-on with professional help, you can resolve your tax liabilities and avoid further complications with the IRS.

CP14 Notice Example

External References

- IRS Official Website – for official guidelines and information directly from the IRS.

- National Association of Tax Professionals – for finding qualified tax professionals.

- Taxpayer Advocate Service – an independent organization within the IRS that helps taxpayers resolve issues.

Remember, a proactive approach and professional guidance can make a significant difference in resolving issues related to IRS CP14 notices.